As U.S. markets witnessed a blood bath on Thursday, owing to the imposition of tariffs by the Trump administration and growing recessionary fears, a handful of stocks thoroughly defied the odds, rallying amid the broader chaos.

What Happened: The Dow, S&P 500, and the Nasdaq, all witnessed their steepest declines since the pandemic, with most U.S. stocks ending the day in the red.

See More: Ford Launches ‘From America, For America’ Discount Program As Tariffs Threaten Vehicle Price Surge

Yet, a few outliers such as the Goodyear Tire & Rubber Co GT, Lamb Weston Holdings Inc LW, First Solar Inc FSLR, Dollar General Corp DG, and the American Water Works Company Inc AWK have managed to win the day.

| Company | Yesterday | Year-to-Date | 52-Week Range |

| Goodyear Tire & Rubber Co. GT | +11.73% | +16.46% | $7.27 – $13.78 |

| Lamb Weston Holdings Inc. LW | +10.01% | -9.80% | $47.90 – $89.51 |

| First Solar Inc. FSLR | +4.94% | -26.94% | $120.60 – $306.77 |

| Dollar General Corp. DG | +4.66% | +24.83% | $66.43 – $164.12 |

| American Water Works Company AWK | +3.95% | +22.69% | $66.43 – $164.12 |

1) Goodyear Tire & Rubber Co.

Goodyear Tire & Rubber was a bright spot on Thursday, rallying nearly 12% amidst all the chaos, making it the day’s top gainer.

Edison Yu, an analyst at Deutsche Bank, believes Goodyear to be a ‘relative winner’ of Trump’s trade wars, as most of its U.S. demand is filled with domestic manufacturing. As a result, it is less exposed to tariffs on imports, relative to peers in this industry.

Yu further adds that Goodyear’s focus on replacement tires, which make up 85% of its revenue, is set to benefit from the auto tariffs, as consumers will stick with their vehicles longer, leading to more tire changes. The stock has been upgraded to a ‘BUY’ with a price target of $13, as reported by Investing.com.

2) Lamb Weston Holdings Inc

Consumer staples were, in fact, only 1 of 11 sectors in the S&P 500 to finish the day higher, as investors rushed to safe havens, and Lamb Weston Holdings was one of them, gaining 10%.

Analysts like Citi’s Filippo Falorni have long considered staples to be recession-proof and resilient in the face of uncertainty, telling the Wall Street Journal that investors can expect ‘stable earnings and revenue even in a tough environment.’

3) First Solar Inc

First Solar rallied nearly 5% on Thursday, being an American-made solar panel company, which allows it to dodge tariffs that apply to its competitors.

Chinese-made solar panels, which were the company’s biggest competitors, are now at a considerable disadvantage. Renewable Energy World reports that investors in solar energy will seek to avoid the massive 54% tax on Chinese panels, while also earning the tax credits from the Inflation Reduction Act, giving a strong impetus to First Solar.

4) Dollar General

Investors likely pursued Dollar General as another recession-proof stock, being a major discount retailer with nearly 20,000 stores, leading to a 4% spike on Thursday, and an 18% rally since the beginning of March.

However, this theory doesn’t hold up too well, as Billy Duberstein writes for the Motley Fool, that during the post-pandemic inflationary period, Dollar General was hit with an expensive combination of inflation hitting its low-income customers’ purchasing power, along with a rise in theft.

5) American Water Works

A public utility that provides water and wastewater solutions, American Water Works is well insulated from global trade, tariffs, and geopolitics, making it the perfect safe haven stock.

People are unlikely to stop using water during a recession, and add to this, the stock offers an annualized yield of 2%, making it a great pick for those looking to overcome the tariff upheaval.

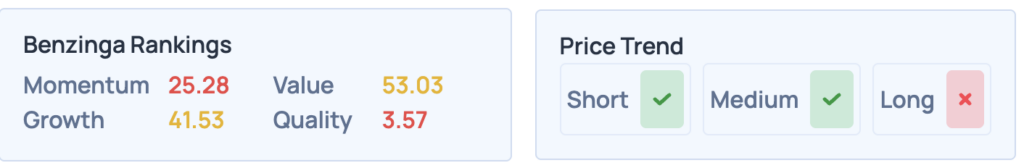

According to Benzinga Edge Stock Rankings, Dollar General paints a pretty mixed picture as of now, but what about the others on this list? Sign up to Benzinga Edge today and find out.

Image via Shutterstock

Read More: Trump Ends De Minimis Exemptions: Shopify, BigCommerce And Lightspeed Face New Headwinds

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.